RSS News Feed

- XRP Price Rally Accelerates, $1.50 Resistance Could Decide Next Move

XRP price started a decent increase above $1.40. The price is now consolidating gains and might aim for more gains above the $1.50 zone. XRP price started a decent upward move above the $1.420 zone. The price is now trading above $1.4250 and the 100-hourly Simple Moving Average. There was a break above a key bearish trend line with resistance at $1.3820 on the hourly chart of the XRP/USD pair (data source from Kraken). The pair could continue to move up if it settles above $1.50. XRP Price Rally Reaches Resistance XRP price started a fresh upward move above $1.40 and $1.420, like Bitcoin and Ethereum. The price gained pace for a clear move above the $1.450 resistance. There was a break above a key bearish trend line with resistance at $1.3820 on the hourly chart of the XRP/USD pair. The bulls even pumped the price toward the $1.50 zone. A high was formed at $1.4936 and the price started a consolidation phase. There was a drop below the 23.6% Fib retracement level of the upward move […]

- Crypto’s Biggest Bull Run Could Come From The Most Unexpected Place: AI Bubble

The crypto markets are sitting in a mood that rarely looks like hope. Fear sits very high, and that kind of fear has traders asking whether the worst is already behind them or still to come. Extreme Fear And Market Signals Reports note the Crypto Fear & Greed Index recently hit a low of 11, one of the weakest readings this year. That kind of reading has shown up near big turns before, but it is not a guarantee of an instant rebound. Related Reading: Bullish Signal? Coinbase Bitcoin Premium Turns Positive After Months In Red Some pieces of market data point to deeper stress — consumer credit trouble, weak housing figures, and loan strain — while other parts of the market, especially certain tech sectors, have kept rising. One analyst warns that what looks like calm at the surface may be hiding pressure underneath. Jesse Eckel argues the broader economy has been dragged forward by gains in AI-driven stocks, even though many everyday measures show strain. His view: investors who […]

- Bitcoin Flips To A Premium On Coinbase As US Institutions Absorb Global Retail Panic – Details

Bitcoin is struggling to push decisively above the $66,000 level as persistent selling pressure continues to weigh on sentiment across the crypto market. Price action remains fragile, with bears maintaining short-term control while buyers show limited conviction. The broader environment — marked by cautious liquidity conditions and subdued risk appetite — has kept Bitcoin locked

- ETHZilla Drops Ethereum Treasury Label in Rebrand After Share Price Collapse

The move follows investor exits, asset sales and a retreat from holding Ethereum on the public company's balance sheet.

- Buterin explains 4-year roadmap for faster, quantum-resistant Ethereum

“The goal is to decouple slots and finality, to allow us to reason about both separately,” explained Ethereum co-founder Vitalik Buterin.

- Ethereum Price Rally Hits Wall at $2,150 After Explosive 15% Move

Ethereum price started a major rally above the $2,000 resistance. ETH is now correcting gains from $2,150 and might decline to $2,000. Ethereum started a fresh upward move above the $1,950 zone. The price is trading above $2,000 and the 100-hourly Simple Moving Average. There was a break above a bearish trend line with resistance at $1,920 on the hourly chart of ETH/USD (data feed via Kraken). The pair could start a fresh decline if it stays below the $2,120 zone. Ethereum Price Rallies Over 15% Ethereum price managed to form a base and traded above the $1,920 resistance, like Bitcoin. ETH price rallied above the $2,000 and $2,020 resistance levels. There was a break above a bearish trend line with resistance at $1,920 on the hourly chart of ETH/USD. The bulls even pumped the price above $2,100. A high was formed at $2,158 before there was a sharp downside correction. The price dipped below the 23.6% Fib retracement level of the upward move from the $1,792 swing low to the $2,158 […]

- Aave crosses $1T in lending as it seeks more bank, fintech integrations

Aave continues to lead DeFi lending, with $27.2 billion in user value secured and $83.3 million in fees over the past 30 days, nearly four times more than its closest competitor.

- How Vitalik Buterin’s 11,422 ETH Liquidation Is Testing Ethereum’s Bear Market Absorption – Details

Ethereum has faced persistent selling pressure throughout the year, with price action repeatedly failing to reclaim the $2,000 level. Despite intermittent rebound attempts, momentum has remained weak, reflecting cautious sentiment across both retail and institutional participants. The broader market environment — characterized by tightening liquidity, macro uncertainty, and subdued risk appetite — has further complicated Ethereum’s recovery path, leaving the asset locked in a fragile consolidation phase. Related Reading: Why XRP’s 0.16 Leverage Floor Ends The Era Of The Flash Crash – And the Hope for a Quick Recovery Recent on-chain data has added another layer to this narrative. According to blockchain analytics platform Arkham, Ethereum co-founder Vitalik Buterin has sold an additional 675.88 ETH, worth roughly $1.25 million, in the past several hours. Over the last month alone, his total ETH sales have reached approximately 11,422 ETH, equivalent to about $23.33 million […]

- Bitwise Plants Its Flag In ETF Staking With Chorus One Buyout

Crypto asset manager Bitwise just made one of its boldest moves yet. The company has acquired Chorus One, a staking infrastructure firm that manages more than $2.2 billion in assets across dozens of blockchain networks. The deal brings 50 Chorus One employees into Bitwise’s growing onchain division, where several billion dollars in crypto assets are

- Bitcoin Price Explodes Higher, $70K Level Faces Fresh Bullish Assault

Bitcoin price started a major increase above $68,000. BTC is now struggling to clear the $70,000 resistance and might correct some gains. Bitcoin started a fresh increase after it settled above the $67,000 support. The price is trading above $67,500 and the 100 hourly simple moving average. There was a break above a bearish trend line with resistance at $66,500 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair might dip again if it trades below the $67,500 and $67,200 levels. Bitcoin Price Rallies 10% Bitcoin price managed to form a base above the $66,000 zone. BTC started a fresh increase and was able to surpass the $67,000 resistance zone. The price even rallied above the $68,000 resistance. Finally, the bears appeared near $70,000. A high was formed at $70,000, and the price is now correcting gains below the 23.6% Fib retracement level of the upward move from the $62,500 swing low to the $70,000 high. Bitcoin is now trading above $67,500 and the 100 hourly […]

- ETHZilla shares pop as it rebrands to Forum in tokenization pivot

ETHZilla will now go by Forum in its second rebrand in less than 12 months as it looks to catch a windfall from the hype around tokenization.

- UK security committee chair urges temp ban on crypto political donations

The Reform UK party was the first to accept crypto donations in May last year, with leader Nigel Farage announcing the group is accepting Bitcoin and other cryptocurrency contributions.

- From Breakdown To Bottoming? Ethereum Tests Key High-Timeframe Support

After losing key structure and breaking below major support, Ethereum is now approaching a critical high-timeframe demand zone. This level has historically acted as a foundation for reversals, making it a pivotal area to watch. The question now is whether the breakdown extends, or if this test marks the beginning of a broader bottoming process. High-Timeframe Support Lost After Repeated Rejections In a recent Ethereum analysis, crypto analyst Luca outlined why the breakdown below the high-timeframe support range marked in purple significantly shifted the market structure. After losing that level and facing repeated rejections, the probability tilted toward continued downside. The failure to recover that zone signaled weakening bullish momentum and opened the door for the price to seek liquidity lower. Related Reading: Ethereum Caught Between Weak Bounce And High-Timeframe Risk – What’s Next? The most logical downside target sits at the high-timeframe support range marked in green, […]

- Solana Price Prediction: ETF Inflows Fuel SOL Push Toward $90 Barrier

Solana (SOL) is attempting to stabilize after weeks of selling pressure, with price action now centered around a critical technical zone that could determine its next directional move. Related Reading: MoneyGram Joins Cardano’s Midnight As Federated Mainnet Validator After falling from recent highs near $86, the Solana price rebounded from support around $75–$76 and climbed

- Jane Street Speculation Renews Scrutiny of Bitcoin ETF Market Mechanics

Online claims have drawn attention to how institutional middlemen hedge Bitcoin ETF shares, exposing a gap between inflows and spot buying.

- Anthropic, OpenAI Dial Back Safety Language as AI Race Accelerates

Reports show both Anthropic and OpenAI are revising safety commitments amid surging investment and competition.

- Ethereum DeFi Warning: Vitalik Flags Oracles As A Hidden Time Bomb

Ethereum co-founder Vitalik Buterin is urging the Ethereum ecosystem to treat oracle design and decentralization as a priority security problem, warning that key parts of DeFi’s stack still hide uncomfortable fragilities behind the industry’s recent growth. In a post outlining how the Ethereum Foundation is thinking about DeFi, Buterin framed decentralized finance as “a central part of the value that Ethereum provides” and argued that its next phase must pair renewed innovation with a harder line on security and centralization risks. “Defi is a central part of the value that Ethereum provides. Financial empowerment is a central part of what it means to have agency and freedom in our current world. Finance is far from the only thing that Ethereum is good for, but it is an important thing,” Buterin wrote, positioning DeFi not as a side quest, but as one of Ethereum’s flagship deliverables. Related Reading: Ethereum’s Legal Status Gains Clarity After SEC Leadership Signal […]

- Dogecoin And XRP Open Interest Crash To 2024 Levels, Here Are The Figures

Open interest in the derivatives markets for Dogecoin and XRP has fallen back to levels last seen in 2024, according to data from Coinglass. Slower capital inflows into the broader crypto market and extended outflows have weighed on the price action of these cryptocurrencies, and the impact is now visible in their futures markets, where

- Kalshi boots a US politician off the platform for insider trading

CFTC chair Mike Selig said the agency established a prediction markets advisory to help catch insider traders, warning there would be consequences.

- Elliot Wave Analyst Predicts Bitcoin Price Will Crash In Final Move, What’s The Target?

According to a new forecast from an Elliott Wave analyst, the Bitcoin price could be gearing up for more pain as bearish pressures continue to weigh heavily on it. As a final bear market move, the analyst has projected that Bitcoin could crash by more than 14% from its current price near $65,000. Bitcoin Price Readies For Final Bear Market Plunge Elliott Wave Strategy, a market expert on X who focuses primarily on Elliott Wave structures and analysis, has warned that Bitcoin is entering its final leg down of its current bear market cycle. In his updated post, the analyst declared that BTC’s corrective Wave 4 structure has ended precisely as projected. He summarized the outlook bluntly, stating that the relief phase is finally over and Wave 5 is now in motion. Related Reading: Bitcoin Dominance To Experience Major Crash? Pundit Shares What This Would Mean The accompanying TradingView chart shows Wave 5 beginning at the end of a triangle formation, which marked Wave 4. The projected […]

- Why Is the Crypto Market Surging Today? Breakout Momentum Builds Ahead of U.S. Data

The crypto market is showing renewed strength after several days of volatility, with prices rebounding as traders reposition ahead of key U.S. economic data. A mix of technical recovery, macroeconomic expectations, and market structure dynamics has helped digital assets regain momentum. Related Reading: MoneyGram Joins Cardano’s Midnight As Federated Mainnet Validator After recent selling pressure

- Bitcoin Emerges As Strategic Asset In Emirates NBD Investment Plans

In a sign of the growing convergence between traditional finance and digital assets, Emirates NBD is reportedly exploring the addition of Bitcoin to its investment portfolio. The development reflects a broader shift in institutional strategy, as major financial institutions increasingly recognize BTC’s potential role in portfolio diversification, inflation hedging, and long-term value preservation. Why Emirates NBD Is Exploring Bitcoin Integration Emirates NBD, one of the largest banks in the United Arab Emirates but frequently described as the UAE’s second-largest bank, is actively evaluating whether to add Bitcoin to its investment portfolio. Crypto market commentator MartyParty has mentioned on X that the news stems directly from comments by Maurice Gravier, the Group Chief Investment Officer (CIO) at Emirates NBD, during an appearance on CNBC Squawk Box. Related Reading: Bitcoin Sees “Most Aggressive” Institutional Selling Ever, Analyst Says Gravier’s key points were […]

- Cardano’s Price Remains Under Downside Pressure, But Here’s What Investors Are Up To

With the persistent downside performance of the Cardano price over the past few weeks, its short-term outlook is turning out to be uncertain and highly volatile. However, investors’ action is telling a different story as sentiment quietly recovers among key ADA holders, which could impact and change the course of the altcoin in the near

- Nvidia Earnings Results Steady Markets as AI Spending Debate Intensifies

Nvidia’s earnings lifted technology shares and steadied broader markets, even as investors weigh how long the AI investment cycle can run.

- Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how

Bitcoin markets are bracing for Friday’s $10.5 billion monthly options expiry. Does the data show bulls or bears at an advantage?

- Samsung's Galaxy S26 Billed as First 'Agentic AI Phone'—Here's What That Means

The Galaxy S26 doesn't just answer your questions—it acts on your behalf. Samsung is the first to use the agentic phone label.

- GD Culture Group board authorizes Bitcoin treasury sales

The AI and digital marketing company acquired its 7,500 Bitcoin in September 2025, amid a market-wide collapse in Bitcoin treasury company mNAVs.

- XRP Investors Show Signs of Fatigue Amid 15% Monthly Drop, Are Bulls Preparing a Comeback?

XRP’s price action in February has reflected a market caught between fading momentum and cautious optimism. After weeks of steady decline, the token is trading near $1.37, down roughly 15% for the month, while broader crypto sentiment remains sensitive to macroeconomic signals and shifting liquidity conditions. Related Reading: Dogecoin Vs. Shiba Inu: What Meme Coin Should You Buy For Most Returns In 2026? Despite a weakening short-term structure, several market indicators suggest traders are closely watching for early signs of a potential recovery rather than abandoning the asset altogether. XRP's price trends to the downside on the daily chart. Source: XRPUSD on Tradingview Market Fatigue Emerges as Leverage and Momentum Decline Recent derivatives data points to growing investor exhaustion. According to analytics, XRP’s Estimated Leverage Ratio has fallen to around 0.16, indicating that heavily leveraged traders have largely exited. This reduction in speculative positioning has […]

- Ripple CTO Emeritus Fires Back at XRP Ledger Centralization Claims

Ripple CTO Emeritus David “JoelKatz” Schwartz pushed back against claims that the XRP Ledger (XRPL) is effectively centralized, after founder and CIO of Cyber Capital Justin Bons argued that XRPL’s Unique Node List (UNL) structure makes validators “permissioned” and gives Ripple-aligned entities “absolute power & control over the chain.” The exchange, sparked by Bons’ broader

- OpenAI, Google and Anthropic AI Models Deployed Nuclear Weapons in 95% of War Simulations

As the Department of Defense pushes for greater AI integration, researchers said the top models chose the nuclear option in nearly all war simulations.

- Why Has Ripple Spent $2.7 Billion In Acquisitions In 3 Years, And What Does It Have To Do With XRP?

Ripple, a crypto payments company and the largest XRP holder, has been aggressively expanding and developing its infrastructure for the past three years. Within this short timeframe, the crypto firm has acquired six different companies, spending more than $2.7 billion. While these acquisitions have significantly expanded Ripple’s use cases and demand, many in the crypto

- Morgan Stanley Has Future Plans for Bitcoin Trading, Lending, and Custody

Bitcoin Magazine Morgan Stanley Has Future Plans for Bitcoin Trading, Lending, and Custody Morgan Stanley said at Strategy World that it plans to expand its digital asset offerings, including launching a native crypto custody and exchange solution. This post Morgan Stanley Has Future Plans for Bitcoin Trading, Lending, and Custody first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- US Strategic Bitcoin Reserve could lose 30% in one ruling as Bitfinex battle intensifies

The US Strategic Bitcoin Reserve could lose nearly 30% of its holdings in a single legal move, even if the government does not sell a single coin. Last year, President Donald Trump signed an executive order creating a Strategic Bitcoin Reserve. The order directed the Treasury Department to consolidate government-held BTC into a reserve account The post US Strategic Bitcoin Reserve could lose 30% in one ruling as Bitfinex battle intensifies appeared first on CryptoSlate.

- Kraken introduces fixed-rate crypto loans for its Pro users

The crypto exchange’s new Flexline product lets Pro users borrow against digital assets at fixed rates of 10%–25% APR for terms of up to two years.

- Bitcoin Treasury Company GD Culture May Sell BTC to Buy Back Shares

Another treasury firm could backtrack on accumulating crypto, with GD Culture eyeing Bitcoin sales as a way to boost its stock price.

- Price predictions 2/25: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Bitcoin bulls rushed toward $70,000, and ETH reclaimed $2,000 following a drastic improvement in investor sentiment, but will the gains hold?

- Hut 8 swings to Q4 loss; compute revenue contribution increases

The Bitcoin miner's digital asset losses mounted, even as it advanced a 15-year, $7 billion AI data center lease.

- Bitcoin Price Roars Over 7% to $69,000 as Market Tests Post-Capitulation Range

Bitcoin Magazine Bitcoin Price Roars Over 7% to $69,000 as Market Tests Post-Capitulation Range Bitcoin price climbed more than 8% today, pushing above $69,000 and marking one of its strongest daily moves during months of sell-offs. This post Bitcoin Price Roars Over 7% to $69,000 as Market Tests Post-Capitulation Range first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- Bitcoin, Ethereum and Solana Shorts Get Rekt as BTC Price Rebounds Near $69K

More than $400 million worth of short positions have been liquidated in the last day as Bitcoin nears $69K and Ethereum and Solana surge.

- Bitcoin tops $69.5K after stocks rebound, strong earnings data boost risk appetite

Bitcoin rallied above $69,500 after US stocks turned green on US policy clarity and strong earnings results. Will bulls target $70,000 next?

- Bitcoin reveals a rare bullish cycle bottom signal before bouncing as futures bears tighten their grip

Bitcoin is flashing its most oversold signal on record amid its continued price struggles in this current macroeconomic environment and persistent exchange-traded fund (ETF) outflows. According to CryptoSlate data, BTC's price dipped to around $62,700 over the last 24 hours, while its weekly relative strength index (RSI) printed roughly 25.7. BTC has risen to above The post Bitcoin reveals a rare bullish cycle bottom signal before bouncing as futures bears tighten their grip appeared first on CryptoSlate.

- GD Culture (GDC) Shares Surge as Board Approves Bitcoin Sale to Fund $100M Buyback

Bitcoin Magazine GD Culture (GDC) Shares Surge as Board Approves Bitcoin Sale to Fund $100M Buyback Shares of GD Culture Group ( GDC) surged nearly 15% Wednesday after the company’s board approved the sale of its 7,500 bitcoin. This post GD Culture (GDC) Shares Surge as Board Approves Bitcoin Sale to Fund $100M Buyback first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- Bitcoin Giant Strategy, Coinbase Among Most-Shorted Stocks: Goldman Sachs

Top crypto equities like Bitcoin treasury firm Strategy and crypto exchange Coinbase are among the most shorted stocks, says Goldman Sachs.

- Comdex introduces Comdex TraceOS™ to support victims of fake trading platforms, romance-investment scams and wallet drains

Harlow, Essex, United Kingdom — 25 February 2026 — Comdex Data Services Limited has announced the launch of Comdex TraceOS™, its proprietary blockchain intelligence platform designed to trace cryptocurrency fund flows, assess risk signals, support fraud prevention workflows, and accelerate recovery work for retail scam victims in the United States.

- Brazil’s Best Anonymous Web3 Casinos for Bitcoin and Stablecoins: The 2026 Ultimate Guide

Discover the best anonymous Web3 casinos in Brazil for 2026. Explore top-rated no KYC crypto casinos like Dexsport, offering 10,000+ games, instant payouts in Bitcoin and USDT, and massive welcome bonuses up to $10,000. Play securely and privately with the ultimate guide to decentralized gambling.

- UK Selects Firms for Stablecoin Regulatory Sandbox, Including Revolut

The four firms will now have free reign to experiment in a program that will inform final UK stablecoin rules set to be released later this year.

- Best Decentralized Web3 Casinos in France — Safe Play Without Custody

Discover the best decentralized Web3 casinos in France 2026: non-custodial platforms with full anonymity, on-chain bets, huge bonuses & safe play without custody. Top picks including Dexsport.

- Strategy (MSTR) Becomes Most-Shorted $25B+ Stock, Shares Surge 8%

Bitcoin Magazine Strategy (MSTR) Becomes Most-Shorted $25B+ Stock, Shares Surge 8% Strategy (MSTR) surged on Wall Street after bitcoin’s rally, despite holding the largest short interest — about 14% of its $41.6 B market cap — among $25 B+ global equities. This post Strategy (MSTR) Becomes Most-Shorted $25B+ Stock, Shares Surge 8% first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- Tokenized US Treasurys rise by over $1B since start of 2026

The tokenized US Treasury market had a market capitalization of under $4 billion at the start of 2025 and has been gradually rising.

- MrBeast Employee Fined, Suspended by Kalshi for Insider Trading on YouTube Videos

Kalshi revealed its first enforcement actions Wednesday, against a political candidate and an employee of YouTube star MrBeast.

- Solana leads crypto recovery with 10% gain: Is $100 SOL price next?

Solana price eyes a potential rise toward the $110-$115 range, according to a confluence of bullish technical and onchain indicators.

- Meta’s digital dollar comeback could unlock a $1 trillion Treasury shift Washington is not ready for

Social media giant Meta is quietly plotting a return to stablecoins. This time, however, the primary beneficiary may not be Mark Zuckerberg’s metaverse, but the US Treasury market. On Feb. 24, Coindesk reported that Meta was exploring stablecoin-based payments for a possible rollout in the second half of 2026, likely through a third-party provider rather The post Meta’s digital dollar comeback could unlock a $1 trillion Treasury shift Washington is not ready for appeared first on CryptoSlate.

- Circle beats Q4 earnings estimates as USDC supply jumps 72%; shares surge 20%

The stablecoin issuer reported $770 million in revenue for the final 2025 quarter, beating forecasts as full-year sales rose 64% and USDC circulation topped $75 billion.

- Bitcoin daily gains approach 5% as analysis eyes bullish 'rotation' from gold

Bitcoin began an assault below the 200-week exponential moving average in fresh signs of upward BTC price momentum at the start of the US session.

- Democrat Senator Launches $1.7B Iran Sanctions Probe Into Binance

Senator Richard Blumenthal has launched an inquiry into alleged Iran-linked crypto transfers as Binance pushes back against the claims.

- As Liquidations Spike, Crypto Savings Become a Defensive Allocation

BTC long liquidations hit record levels this February, driving users toward safer yield. Learn how crypto savings—flexible and fixed—serve as a defensive allocation.

- Arbilife Unveils Enhanced Arbitrage Platform, Marking a New Milestone in Low-Risk Crypto Investing

Arbilife, a leading cryptocurrency arbitrage platform, today announces significant enhancements to its core service, reinforcing its position as a reliable solution for stable, market-independent returns.

- How Web3 Projects Can Handle Legal Risk and Compliance in PR

A practical guide for Web3 teams on balancing promotion and compliance: how PR tactics can create legal exposure and how to structure safer, regulator-ready communication

- Circle Stock Jumps Double Digits as It Reports 72% Rise in USDC Circulation

Circle’s USDC grew 72% in Q4 as transaction volume soared and CRCL stock popped on bullish AI and payments commentary.

- Here’s what happened in crypto today

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

- If Bitcoin can hold $65,000 after its strong bounce it could avoid a deeper crypto winter

Bitcoin spent the last two days sliding down familiar shelves, and the order book kept printing lower bids as liquidity thinned. However, by Wednesday afternoon, the price traded back toward $65,000 after sweeping the low $63,000s, with the last 24 hours spanning roughly $62,800 to $66,200. The bounce depicts a market that hit the air The post If Bitcoin can hold $65,000 after its strong bounce it could avoid a deeper crypto winter appeared first on CryptoSlate.

- Strategy yield wrapper lands in Europe as 21Shares lists STRC ETP

21Shares debuts the Strategy Yield ETP on Euronext Amsterdam on Thursday, giving Europe regulated access to Strategy’s preferred stock, which is heavily backed by Bitcoin.

- Blockchain for Good Alliance Names Token Tails Top 2025 Incubation Project for Scalable Stray Cat Rescue Infrastructure

Blockchain for Good Alliance Names Token Tails Top 2025 Incubation Project for Scalable Stray Cat Rescue Infrastructure

- Revolut among 4 companies chosen to test stablecoins in UK sandbox

The UK Financial Conduct Authority selected Monee, ReStabilise, Revolut and VVTX to test stablecoin issuance and payments in its regulatory sandbox beginning in Q1 2026.

- Crypto traders are chasing 10x leverage in the US while Europe tightens the screws behind the scenes

Two regulators converged on the same market from opposite directions in February 2026. The European Securities and Markets Authority warned that derivatives marketed as “perpetual futures” or “perpetual contracts” tied to Bitcoin and Ethereum likely fall within the scope of contracts-for-difference regulations, regardless of what firms call them. Days earlier, US Commodity Futures Trading Commission The post Crypto traders are chasing 10x leverage in the US while Europe tightens the screws behind the scenes appeared first on CryptoSlate.

- Morning Minute: Stablecoins Are Eating Everything

Huge headlines from Stripe and Meta have stablecoins squarely back in the forefront of the crypto discussion.

- FxPro and McLaren Racing Extend Strategic Partnership

FxPro and McLaren Racing Extend Strategic Partnership

- South Korea moves to require crypto, stock influencers to disclose holdings: Report

A proposed law would require online investment influencers to reveal their holdings and paid promotions, with penalties potentially comparable to market manipulation violations.

- FG Nexus sells another $14M in Ether as losses mount on treasury bet

FG Nexus sold another $14 million in Ether from its corporate treasury, bringing its losses to over $80 million as Ether-focused balance sheets come under mounting market pressure.

- Polkadot, Solana Lead Altcoin Surge Ahead of Nvidia Earnings Call

Crypto markets climb 3% as traders position for Nvidia's earnings, which analysts say now overshadow the SOTU as the key catalyst.

- Aave governance dispute escalates as ACI and Aave Labs publish dueling reports

Competing reports outline contrasting views on protocol revenue, development and funding accountability.

- Bitcoin miners sell $348M BTC as power costs bite and the $7.4 billion treasury begins shrinking fast

Public Bitcoin miners collectively held 115,335 BTC as of Feb. 20, worth roughly $7.4 billion at the recent price, but that treasury dropped 4.44% month-over-month, the first sustained contraction since miners began stockpiling coins as balance-sheet assets. The decline wasn't an accident. Riot Platforms sold 1,818 BTC in December 2025 for $161.6 million in net The post Bitcoin miners sell $348M BTC as power costs bite and the $7.4 billion treasury begins shrinking fast appeared first on CryptoSlate.

- Phemex Unveils AI Bot, Marking A Product Milestone of Its AI-Native Revolution

Phemex Unveils AI Bot, Marking A Product Milestone of Its AI-Native Revolution

- When Markets Get Shaky, Builders Show Up. Here Are the Key Crypto Conferences To Attend in 2026

With Bitcoin and several other major assets witnessing a 40+% drop from their recent highs, 2026 has undoubtedly marked one of the worst starts to the year for crypto in more than half a decade.

- Judge Dismisses xAI Trade Secrets Lawsuit Against OpenAI, Allows Refiling

A federal judge has ruled that xAI's complaint failed to connect OpenAI to any alleged theft by former employees.

- Bitcoin price climbs 3% as gold divergence signals ‘significant upside’

Bitcoin’s failure to replicate gains in gold and stocks over the last six months may result in a delayed rally as BTC price returns to $65,000.

- Bitcoin Rebounds from $63K Lows: Short Correction or Sustainable Rally Starting? – BTC TA February 25, 2026

Having entered quite oversold territory, Bitcoin is starting to turn back around after threatening to take out the $60,000 local low. Can the $BTC price finally catch a bid and avoid a deeper leg down into the depths of the bear market, or is this nothing but a short respite for the bulls?

- A record 206% stock bubble is building pressure that threatens Bitcoin’s recovery

Bitcoin is entering a period where macro sequencing matters more than narrative. Equity markets are trading near record valuations, real yields remain elevated, and credit markets are expanding into increasingly opaque corners of the financial system. None of these conditions guarantees an imminent break. But together they form the backdrop for what could become a The post A record 206% stock bubble is building pressure that threatens Bitcoin’s recovery appeared first on CryptoSlate.

- US senator launches probe into Binance over Iran, Russia sanctions claims

Binance rejected the allegations, saying it flags suspicious activity, enforces strict compliance procedures and does not permit Iranian users on the platform.

- Crypto in Global Finance – Impact on Institutional Strategy

Crypto in global finance is reshaping capital markets, regulation, and investment. Explore adoption trends, risks, and real-world integration for 2026.

- Bitcoin bounces to $66K as rumors swirl over Jane Street selling algorithm

Bitcoin traders had mixed opinions over what caused a BTC price rebound past $66,000 as attention focused on Jane Street selling pressure.

- Anchorage buys STRC as Wall Street shorts mount against Saylor’s Bitcoin proxy

Strategy has become the most-shorted large-cap US stock as hedge funds ramp up bearish bets, according to data from Goldman Sachs.

- Dexsport Review 2026: A Licensed No-KYC Crypto Betting Platform Expanding Its Ecosystem

The crypto betting sector looks markedly different in 2026 than it did a few years ago. What was once considered an experimental niche has developed into a parallel iGaming environment.

- US seizes $61M in USDT linked to ‘pig butchering’ crypto fraud scheme

The $61 million USDT seizure in North Carolina shows how US authorities can trace and freeze stablecoin flows tied to pig butchering scams, as AI‑driven impersonation schemes surge.

- Bitcoin ETFs post $258M inflows as institutional Q4 selling hits 25,000 BTC

US spot Bitcoin ETF flows turned green on Tuesday, with Fidelity and BlackRock leading gains despite persistent weak market sentiment.

- Hong Kong to link new digital bond platform with regional tokenization hubs

Hong Kong will build a digital asset platform for tokenized bond issuance and settlement, while moving ahead with stablecoin licensing and CARF.

- Bitcoin adoption is booming, even if its price isn’t: River

River reports that Bitcoin adoption surged in 2025, cementing it as a mature asset class, even as its price has halved since hitting a peak in October.

- Coinbase CEO Pushes Back on UK Stablecoin Caps as Token Profits Surge

The proposal would cap stablecoin holdings and curb yields, a move critics say could push liquidity overseas as stablecoins become a core revenue stream.

- South Korean man indicted in alleged pesticide poisoning tied to crypto losses

South Korean prosecutors reportedly accused a man of poisoning a business partner with pesticide in a dispute over losses due to crypto trading.

- Bitcoin Ticks Higher as Markets Weigh Trump Address, Broader Risk Sentiment

Bitcoin remains sensitive to broader risk sentiment, with traders positioning ahead of Nvidia’s earnings and a rebound in global stocks.

- Stripe in Early Talks on Potential PayPal Deal: Bloomberg

The deal could combine two major payments firms already expanding into stablecoin and crypto infrastructure.

- Treasury Sanctions Russian ‘Exploit’ Broker Over Stolen US Cyber Tools

It marks the first use of the Protecting American Intellectual Property Act, targeting a firm accused of brokering stolen U.S. cyber tools.

- Coinbase, Kraken and Binance Push Deeper Into Tokenization as Capital Shifts

Tokenized real-world assets have continued to expand despite a broader market slide, with assets distributed on-chain up nearly 300% year over year.

- Bitcoin Depot Will Require ID for 'Every Transaction' at ATMs Amid Growing Pressure

Bitcoin Depot will begin verifying customers’ identities each time they use its ATMs, voluntarily refining its compliance procedures.

- U.S. Treasury Sanctions Russian Exploit Broker Over Crypto-Funded Cyber Theft

Bitcoin Magazine U.S. Treasury Sanctions Russian Exploit Broker Over Crypto-Funded Cyber Theft The U.S. Treasury sanctioned a Russian network for buying stolen government cyber tools with crypto and reselling them, the first action under the Protecting American Intellectual Property Act. This post U.S. Treasury Sanctions Russian Exploit Broker Over Crypto-Funded Cyber Theft first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- OpenAI Says Benchmark Used to Measure AI Coding Skill Is 'Contaminated'—Here's Why

OpenAI wants to retire the leading AI coding benchmark—and the reasons reveal a deeper problem with how the whole industry measures itself.

- 'Stablecoin Summer': Stripe Makes Tender Offer at $159 Billion Valuation

Payments giant Stripe made a tender offer valuing the firm at $159 billion as payments and stablecoin volumes rise.

- Bitcoin rejects $62k as spot ETF flows swing positive — but if we lose this floor things get ugly

Bitcoin spent the last two days sliding down a familiar set of shelves, and the order book kept printing lower bids as liquidity thinned. By Tuesday morning, it sat at $63,214, a level that places the price inside the lower band on my two-year channel map. Over 24 hours, Bitcoin fell 4.83%, from an open The post Bitcoin rejects $62k as spot ETF flows swing positive — but if we lose this floor things get ugly appeared first on CryptoSlate.

- After Donating $35 Million to Trump PAC, Crypto.com Scores Wins From Regulators

Weeks after giving another $5 million to a pro-Trump PAC, the exchange received lawsuit aid from the CFTC and a bank charter from the Treasury Department.

- Michael Saylor Confirmed As A Speaker For Bitcoin 2026

Bitcoin Magazine Michael Saylor Confirmed As A Speaker For Bitcoin 2026 Bitcoin Magazine readers can save 10% on tickets to Bitcoin 2026, featuring Michael Saylor and hundreds of global leaders across Bitcoin, finance, mining, energy, and policy. April 27–29 at The Venetian, Las Vegas. This post Michael Saylor Confirmed As A Speaker For Bitcoin 2026 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

- South Korean Man Faces Murder Charge Over Bitcoin Bet Gone Bad

Prosecutors in Seoul say a man poisoned his business partner after the colleague mismanaged his Bitcoin investments.

- Numo Launches Bitcoin Tap-to-Pay App for Merchants, Powered by Cashu

Bitcoin Magazine Numo Launches Bitcoin Tap-to-Pay App for Merchants, Powered by Cashu Numo has launched a free, open-source Android tap-to-pay app powered by Cashu that lets merchants accept Bitcoin via NFC and Lightning with no extra hardware or platform fees. This post Numo Launches Bitcoin Tap-to-Pay App for Merchants, Powered by Cashu first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- Solo Miner Turns $75 into $200,000 Bitcoin Block Reward Using Rented Hashrate

Bitcoin Magazine Solo Miner Turns $75 into $200,000 Bitcoin Block Reward Using Rented Hashrate A solo miner turned $75 in rented hashpower into a $200,000 Bitcoin block reward, defying steep odds in a rare, lottery-like win. This post Solo Miner Turns $75 into $200,000 Bitcoin Block Reward Using Rented Hashrate first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- The Core Issue: Keeping Bitcoin Core Secure

Bitcoin Magazine The Core Issue: Keeping Bitcoin Core Secure From The Core Issue: a look at how Bitcoin Core handles security vulnerability disclosures, testing for bugs, and patching them. This post The Core Issue: Keeping Bitcoin Core Secure first appeared on Bitcoin Magazine and is written by Niklas Gögge.

- Solo Bitcoin Miner Nabs $200K After Renting $75 Worth of Hash Power

Despite incredibly long odds, someone scored a $200K BTC block reward after spending just $75 to rent Bitcoin mining power.

- Bitcoin set for record 5th monthly loss in a row as ETF outflows put $58,000 in sight

Bitcoin is heading toward an uncomfortable milestone, a potential fifth consecutive monthly decline if February closes in the red, and the setup is starting to look less like a crypto-specific drawdown and more like a macro-driven repricing. This five-month losing streak would be notable in the post-ETF era and would also be Bitcoin’s longest stretch The post Bitcoin set for record 5th monthly loss in a row as ETF outflows put $58,000 in sight appeared first on CryptoSlate.

- Bitcoin Miner Canaan Acquires Cipher’s Stake in Texas Mining Projects, Expands AI and Power Strategy

Bitcoin Magazine Bitcoin Miner Canaan Acquires Cipher’s Stake in Texas Mining Projects, Expands AI and Power Strategy Canaan (CAN) acquired Cipher Mining’s 49% stake in three West Texas mining projects for $39.75 million in shares, giving Cipher a significant equity stake in Canaan. This post Bitcoin Miner Canaan Acquires Cipher’s Stake in Texas Mining Projects, Expands AI and Power Strategy first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

- 0% APR Crypto Loans: LTV Conditions, Terms and Costs Across Platforms

0% APR crypto loans explained. Review LTV requirements, terms, and costs across major platforms, and see how Clapp’s credit-line model enables true usage-based borrowing.

- Top 5 Crypto Apps for Fast BTC Purchases with USD: Which One Wins for Flexibility?

Looking to buy BTC with USD fast? Compare the top 5 crypto apps for speed, flexibility, and transparency — including SwapSpace, a non-custodial aggregator with real-time rate comparison.

- WisdomTree Gets SEC Nod to Enable Instant Settlement for Tokenized Money Market Fund

WisdomTree is enabling instant settlement for its tokenized money market fund, indicating its product won't be limited by Wall Street’s pace.

- Crypto Continues Sliding This Week as ETF Outflows Signal Institutional Pullback

Crypto ETFs record $245M in net outflows as institutional capital exits. Extreme fear and long liquidations pressure Bitcoin and the broader market.

- Wallet Betting vs Account Betting: Which Is Safer for Crypto Players in 2026?

Account vs wallet betting in 2026: compare security, privacy, fees, and real crypto hacks. Discover why non-custodial Web3 betting is safer for crypto players.

- Only 41% of Bitcoin holders are in profit this cycle – threatening worst halving on record

As Bitcoin trades in the low-$60,000s, the ledger shows nearly half of holders are sitting on losses. Newhedge’s percent supply in profit gauge shows 51.78% of coins are in profit with BTC around $63,275, implying roughly 10.35 million BTC in profit versus 9.64 million BTC in loss. However, this weekend, analyst DurdenBTC’s supply in profit The post Only 41% of Bitcoin holders are in profit this cycle – threatening worst halving on record appeared first on CryptoSlate.

- Anonymous Sports Betting in Europe 2026: Best No-KYC Crypto Sportsbooks Without ID Checks

Stay private with the best no-KYC crypto sportsbooks in Europe for 2026. Avoid DAC8 reporting and ID checks with anonymous sports betting sites. Bet on football and more using BTC, ETH, or USDT securely.

- Trump’s White House Has One View of Crypto Legislation. His Family’s Crypto Company Has Another

World Liberty Financial is backing Coinbase on the crypto market structure bill debate, even as the White House criticizes the company.

- Ethereum Foundation Starts Staking Treasury Amid Vitalik Buterin's ETH Sales

The Ethereum Foundation began staking ETH as part of new treasury operations amid a string of sales from co-founder Vitalik Buterin.

- Bitcoin Traders Expect More Pain Ahead After BTC Falls 50% From Peak

Bitcoin dropped below the $63,000 mark overnight, falling more than 50% from its October peak as traders project a further dip ahead.

- 21shares Spot SUI ETF (Nasdaq: TSUI) to Begin Trading on Tuesday Feb 24th, Expanding U.S. Access to Sui

21shares Spot SUI ETF (Nasdaq: TSUI) to Begin Trading on Tuesday Feb 24th, Expanding U.S. Access to Sui

- Solana DeFi Project Step Finance to Wind Down Weeks After $29M Hack

The Solana projects made the "difficult decision" to cease operations after January's treasury breach and subsequent failed rescue efforts.

- Morning Minute: Ethereum's Next Upgrade Features Censorship Resistance

Ethereum is going back to its cypherpunk ethos with FOCIL—but it could create compliance issues down the line.

- Bitcoin's Path to Recovery 'Unclear' Amid Macro Headwinds

Bitcoin has flashed rare bottom signals, but macro headwinds are keeping a sustained recovery at bay, analysts told Decrypt.

- Crypto Exchange Explained: Essential Facts for Beginners

What is a crypto exchange? Learn its types, features, regulation, key risks, and costs in 2026. Start trading with confidence and global insight.

- Arizona Senate Advances Bill to Create Digital Assets Reserve Fund

The bill would allow Arizona to hold Bitcoin, XRP, Digibyte, stablecoins, and NFTs in a state-managed crypto reserve.

- Bitcoin Falls Below $63,000: Can Anything Stop the Downward Rot? – BTC TA February 24, 2026

Bitcoin briefly fell under $63,000 early on Tuesday following another corrective leg down that lopped off 8.6% from the price. With the local low at around $60,200, the $BTC price is not far from a cliff edge that leads all the way down to $53,000. Will Bitcoin go over?

- ChatGPT’s Listing Strategy for a $15 000 Budget: What It Gets Wrong

For many early-stage founders, choosing the right exchange for the first listing is one of the most decisive moves in the entire go-to-market strategy. With dozens of CEXs, hundreds of DEXs, and a saturated launchpad landscape, a listing is no longer just a milestone.

- Fed Moves to Permanently Drop ‘Reputational Risk’ From Bank Supervision

Supporters say clearer rules are needed to replace informal supervisory pressure, as lawmakers and industry push Congress to settle crypto banking access.

- Terraform Estate Sues Jane Street Over Trades Tied to 2022 Crypto Market Collapse: WSJ

The lawsuit alleges the trading firm positioned itself around undisclosed liquidity shifts as TerraUSD unraveled in 2022.

- Bitcoin's Slide to $64,000 Is a 'Macro Shock,' Not a Market Breakdown

Bitcoin's 50% drop from its October peak is a macro shock in an overleveraged market, not a broken cycle, experts claim.

- Is Artificial General Intelligence Already Here? One AI Founder Thinks So

The comments arrive as developers struggle to secure AI systems that behave less like software and more like humans.

- Borrowing During Market Volatility: How to Manage Liquidation Risks in Crypto Lending

Learn how to manage liquidation risks when borrowing against crypto during market volatility. This review explains LTV mechanics, loan structures, and how platforms like Clapp help borrowers stay protected.

- Top Crypto Exchange Aggregators for 2026: Terms and User Experience Compared

Q2 2026 review of top crypto exchange aggregators. Compare SwapSpace, 1inch, Changelly, ChangeNOW, and StealthEX by terms, costs, supported assets, execution quality, and privacy features. Includes FAQ and detailed comparison tables.

- No-KYC or Regulated? Best Web3 Casinos for Privacy-Focused Players Worldwide

Compare no-KYC vs regulated Web3 casinos in 2026: best anonymous crypto casino sites with instant withdrawal, privacy tips & top picks for Boston players.

- Outset PR Launches Press Office to Help Crypto Brands Earn Coverage and Build Trust

Outset PR launches its Press Office service to help crypto brands earn credible media coverage, strengthen trust, and become consistent expert sources. Explore how the model works and see real results from StealthEX and Nav Markets.

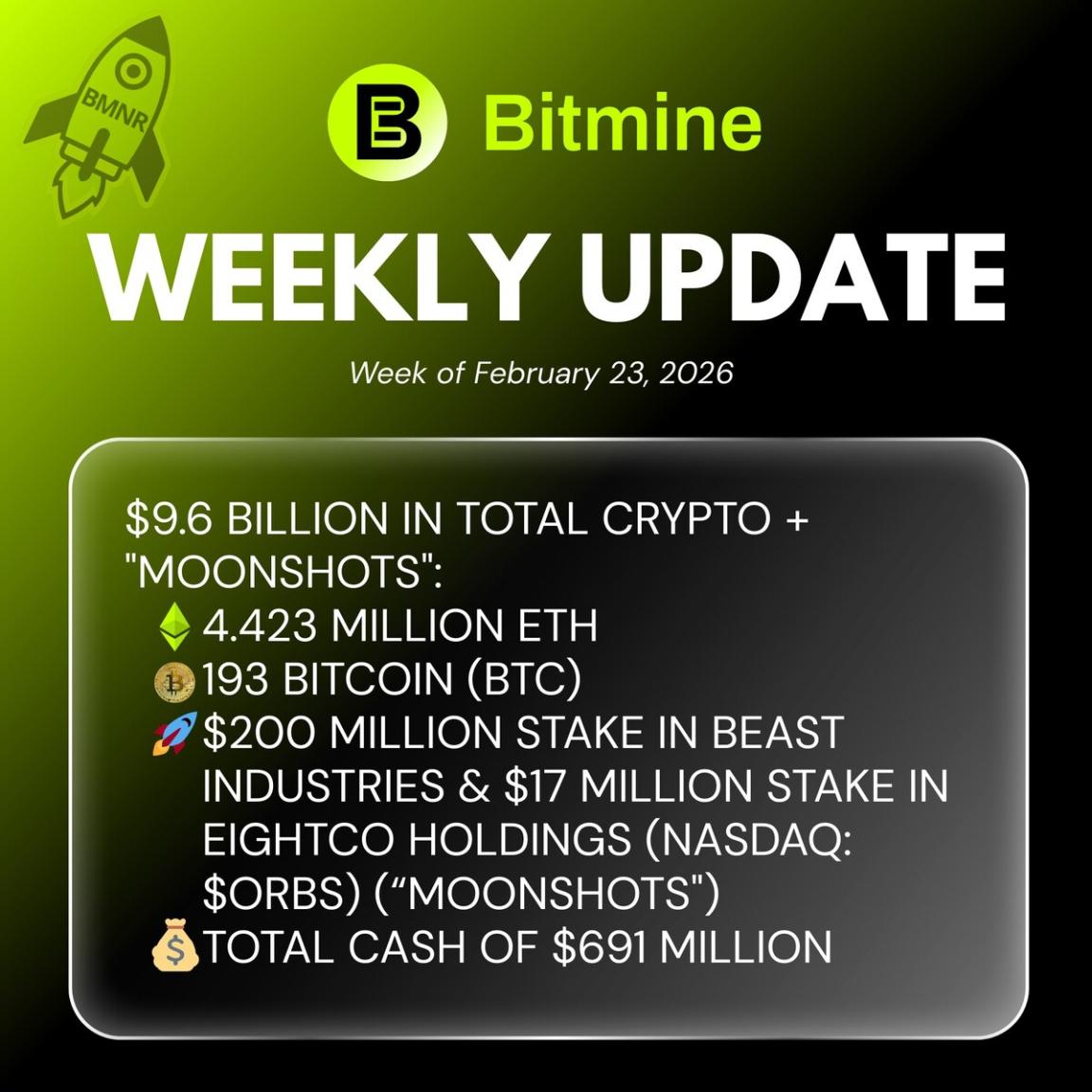

- Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.423 Million Tokens, and Total Crypto and Total Cash Holdings of $9.6 Billion

Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.423 Million Tokens, and Total Crypto and Total Cash Holdings of $9.6 Billion

- How to Track Crypto Prices

Learn how to track crypto prices step by step and make informed Bitcoin and Ethereum investment decisions with easy-to-follow strategies and tools.

- BTC Closes Below $69,000 Weekly: Bulls Done or Relief Ahead? (Feb 23 Update)

A weekly close below the $69K major horizontal level has either confirmed that the next leg down in the Bitcoin bear market is about to begin, or it is yet another flush-out of investors who are desperately hanging in there. Is a recovery still possible from such a position, or was this the death knell?

- How to Earn Yield in a Crypto Winter: Adjusting Crypto Savings Strategies for 2026

Learn how to navigate the 2026 crypto winter with disciplined strategies and structured yield using Clapp’s Flexible and Fixed Savings products.

- Optimism Returns to Crypto Market as Geopolitical Tensions Ease

Crypto market rebounds 3% after U.S. Supreme Court strikes down Trump-era tariffs, easing macro uncertainty. Bitcoin reclaims key $67,957 level.

- Anonymous Horse Racing Betting Explained — Best BTC & USDT Platforms

Anonymous horse racing betting explained. Compare the best BTC & USDT platforms with no KYC, fast payouts, live markets, and secure crypto racebook options.

- Bitcoin: Portfolio Growth and Stability

Why invest in Bitcoin for 2026? Learn how Bitcoin provides digital scarcity, institutional adoption, and diversification for tech-savvy investors.

- Five Ways to Buy ETH This Spring: From CEX to Exchange Aggregators

Looking to buy ETH this spring? Compare CEX, DEX, on-ramps, and exchange aggregators like SwapSpace to find the right method for you.

- Planning a Successful Crypto PR Campaign in the United States: 2026 Strategy

Discover a data-driven guide on how to build an effective crypto PR campaign in the US: tactics top teams use to run successful crypto PR campaigns, from tier-1 media strategy to AI and social discovery.

- Licensed Web3 Casino Gambling Explained — Best Regulated Platforms Globally

Explore licensed Web3 casino gambling in 2026: regulated platforms with blockchain transparency, provably fair games & strong protections. Top picks: Dexsport, Betpanda, FanDuel, DraftKings for U.S. players.

- Anonymous Web3 Gambling in Germany: Top Crypto Casinos Without ID Verification

Discover the top anonymous Web3 crypto casinos for German players in 2026: no KYC, instant withdrawals, massive bonuses & full privacy. Best no-verification platforms with BTC, ETH & more.

- Cryptocurrency Price Prediction Workflow

Master a step-by-step cryptocurrency price prediction workflow. Learn setup, choose tools, analyze data, and verify your results easily.

- Dexsport Wallet Betting Guide: No Accounts, No Custody, No Delays and Big Bonuses

Learn how Dexsport’s wallet-based betting works. No accounts, no custody, instant payouts, and big bonuses. A full guide to using Web3 wallet betting in 2026.

- Why Use Cryptocurrencies: Powerful Benefits

Why use cryptocurrencies? Discover core definitions, major types, inflation protection, investing risks, and smart tax strategies for global investors.

- Bitcoin-Backed Loans Explained: How to Borrow Cash Without Selling BTC

Learn how Bitcoin-backed loans work and how to borrow cash without selling BTC. This explainer covers LTV, risks, and flexible credit-line options like Clapp.

- Q2 2026 Review of Crypto Exchange Aggregators [Terms and Execution Compared]

Comprehensive Q2 2026 review of crypto exchange aggregators. Compare SwapSpace, 1inch, Changelly, and ChangeNOW by execution speed, KYC exposure, and cross-chain support.

- How to Build Effective Crypto PR Campaign in South Korea in 2026

A 2026 guide to building effective crypto PR campaigns in South Korea, covering Korean media dynamics, compliance strategy, and insights from Outset PR’s regional traffic analysis.

- IP Strategy Announces Share Repurchase Program of Up To 1 Million Shares

IP Strategy Announces Share Repurchase Program of Up To 1 Million Shares

- Phemex Completes Full Integration of Ondo Finance Tokenized Equity Suite

Phemex Completes Full Integration of Ondo Finance Tokenized Equity Suite

- Gold at $5K & Silver Rallying: Is Bitcoin ($67K) Set to Follow the Safe-Haven Surge?

As huge uncertainty builds on the world stage with the US/Iran face-off, investors are once more turning to gold and silver to park their wealth. Both of these assets are signalling potential breakouts. Down in the depths of a bear market, could Bitcoin be about to follow?

- Where to Earn Interest on Bitcoin in 2026?

Looking to earn interest on BTC in 2026? Compare Clapp, Rootstock/Sovryn DeFi, and Bitcoin banking services like Xapo and River.

- Best Licensed Web3 Sportsbooks for Premier League and European Football Markets

Discover the top licensed Web3 sportsbooks for Premier League and European football markets. Compare fast payouts, altcoin support, live odds, and secure betting options.

- Where to Bet on Football with Bitcoin in Brazil Anonymously

Find the best anonymous Bitcoin football betting sites in Brazil. Compare no-KYC sportsbooks, fast BTC payouts, and top markets for Brasileirão and European leagues.

- Unicity Labs Raises $3M to Scale Autonomous Agentic Marketplaces

Unicity Labs Raises $3M to Scale Autonomous Agentic Marketplaces

- Is Now a Good Time to Buy Memecoins? Based Eggman and Pepecoin Could Shock Holders in 2026

Is now a good time to buy memecoins? We analyze the strategic Based Eggman Presale with its CEX listing catalyst vs. Pepecoin's 2026 price prediction & the Pepe Dollar presale. Discover which memecoin could shock your portfolio.

- How to Buy TRX Without Using a Centralized Exchange

Learn how to buy TRX without using a centralized exchange. Compare non-custodial methods, rates, and execution models, including SwapSpace.

- Multi-Currency Crypto Savings: Earning Yield on BTC, ETH, and Stablecoins with Clapp

Earn yield on BTC, ETH, and stablecoins without selling. Explore Clapp’s multi-currency crypto savings with daily compounding and fixed-term options.

- Altcoin Sell-Off Leads the Market Lower as Institutional Interest Cools

Altcoins lead crypto lower as ETF outflows exceed $133M and derivatives open interest falls. Institutional cooling and extreme fear pressure the market.

- 7 Types of Cryptocurrencies Every Person Should Know

Explore 7 essential types of cryptocurrencies to diversify your portfolio. Learn key distinctions and practical uses.

- Phemex Launches AI-Native Revolution, Signaling Full-Scale AI Transformation

Phemex Launches AI-Native Revolution, Signaling Full-Scale AI Transformation

- BTC Price Downtrend Continues: Bearish Momentum Dominates – But Relief Rally Possible? (Feb 19 Update)

The $BTC price is firmly in the grip of the bears. A triangle breakdown points to a dip below the last local low at $60,000. Will the price go there, or has the price come down too fast? Could some kind of relief rally emerge from here?

- Lime co-founder Brad Bao named in $100M federal RICO lawsuit alleging "one of the largest crypto frauds in history"

Brad Bao / X , co-founder of electric scooter company Lime, has been named as a defendant in a federal RICO lawsuit.

- Bitcoin-Backed Credit Explained: Best BTC Collateral Loan Providers in 2026

A 2026 review of the best Bitcoin-backed loan providers, explaining how BTC collateral loans work and comparing Clapp, Nexo, YouHodler, CoinRabbit, and Coinbase.

- Low-Fee Crypto Swaps: How to Exchange ADA to USDT in Minutes

Swap ADA to USDT in minutes with low fees. Compare real-time ADA→USDT rates on SwapSpace, a no-registration aggregator offering fast and competitive crypto swaps.

- Top Altcoin Betting Sites for 2026: Ethereum, Solana, and USDT Options

Explore the top altcoin betting sites for 2026 with Ethereum, Solana, and USDT support. Compare fast payouts, low fees, and the best crypto-friendly sportsbooks.

- How to Plan Effective Crypto PR Campaigns in Europe in 2026

A data-driven look at how to plan effective crypto PR campaigns in Europe, incorporating MiCA compliance, regional media targeting, and search-led discovery trends highlighted in Outset PR’s latest traffic report.

- Bitcoin Price at $67K: Is the Next Leg Down About to Start? – BTC TA February 18, 2026

Bitcoin is very close to falling down again. The price is right at the edge of a triangle and could be about to fall back to $60,000. Will Bitcoin make the drop? How far could it fall?

- Sai Launches Perps Platform Combining CEX Speed with Onchain Settlement

Sai Launches Perps Platform Combining CEX Speed with Onchain Settlement

- Crypto Prices Explained: Key Volatility Drivers

Crypto prices change fast due to supply-demand shifts, global news, regulatory actions, and economic events. Learn what drives crypto volatility.

- BASIS Secures $35 Million in Strategic Capital to Bring Institutional HFT Tech to Retail Staking Markets

A new standard for digital asset infrastructure is set to emerge as BASIS, the strategic arm of renowned blockchain research firm Base58 Labs, confirmed a massive $35 million Pre-Series A capital injection today.

- Aurora Labs Unveils NEAR Intents Widget for Embedded Crypto Features

Over the past year, the conversation around “intents” has quietly grown from mere theory to a thriving, practical infrastructural ecosystem enabling millions of users to express what they want done instead of manually executing every transaction step.

- Zircuit Finance Launches Institutional-Grade Onchain Yield Platform Targeting 8–11% APR

Zircuit Finance Launches Institutional-Grade Onchain Yield Platform Targeting 8–11% APR

- Anonymous or Licensed? Best Web3 Sportsbooks for Crypto Betting in 2026

Discover the best anonymous and licensed Web3 sportsbooks for crypto betting in 2026. Compare no-KYC platforms, trusted regulated sites, bonuses, and payouts.

- From Centralized to Web3: Best Decentralized Crypto Casinos in 2026

Discover the best crypto casino sites in 2026, from decentralized Web3 platforms to hybrid and regulated online crypto casinos. Compare crypto live casino options, new crypto casinos, bonuses, free spins, and the top cryptocurrency casino platforms.

- Pi Network Gains as User Base Grows and Mainnet Migration Accelerates

Pi Network outperforms Bitcoin as user base growth accelerates following its infrastructure upgrade. Key resistance at $0.185 now defines the breakout level.

- Crypto Savings Without Lockups: Where to Earn Daily Interest in 2026

Looking for crypto savings without lock-ups in 2026? Compare Clapp, Binance Earn, Coinbase, and MEXC for daily interest and full liquidity.

- How to Swap Solana to USDT Fast: Trusted Platforms and Rate Comparison

Swap Solana to USDT quickly using trusted platforms. Compare real-time SOL→USDT rates on SwapSpace, a no-registration aggregator offering fast and competitive exchanges.

- Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.371 Million Tokens, and Total Crypto and Total Cash Holdings of $9.6 Billion

Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.371 Million Tokens, and Total Crypto and Total Cash Holdings of $9.6 Billion

- Public Masterpiece Announces PMT Chain, A Layer 1 Built for the Real-World Asset Economy

Public Masterpiece Announces PMT Chain, A Layer 1 Built for the Real-World Asset Economy

- 7 Smart Cryptocurrency Tips for Beginners

Discover 7 actionable cryptocurrency investing tips for beginners. Learn practical strategies to handle market volatility and improve your crypto investments.

- Bitcoin Technical Analysis February 17: Price Compression Builds – Explosive Move Coming?

The Bitcoin price is funnelling into the point of a triangle, and the decision to break up or down is coming soon. If the price breaks up, a move to $80K could be next. On the other hand, a breakdown could see the price fall below $60K. Which will it be?

- 2026 Winter Olympics Betting Guide: Which Sportsbooks Offer Most Competitive Odds?

2026 Winter Olympics betting guide comparing crypto-native betting platforms and regulated online betting sites. Discover which sportsbooks offer the most competitive odds, fastest withdrawals, and strongest live markets.

- Altcoin Season Remains Distant as Capital Rotates from High-Risk Assets

Altcoin Season Index drops to 29 as capital rotates from high-risk assets. Extreme fear and Bitcoin dominance pressure XRP, ADA, and Solana.

- What is a Crypto Exchange Aggregator and How Does It Find Optimal Swap Deals?

Curious about crypto aggregators? Discover how SwapSpace compares 37+ partners to find the best swap rates for 4,000+ coins instantly.

- Bitcoin to USDT Swaps During Extreme Fear: Why Execution Matters in 2026?

With the Crypto Fear & Greed Index below 10 in February 2026, market volatility and pricing dispersion increased sharply. This article examines BTC to USDT swaps during extreme fear and why execution quality, liquidity aggregation, and real-time rate comparison matter.

- KuCoin Institutional Gathers Global Clients in Hong Kong to Focus on Governance and Market Structure

As digital asset markets continue to evolve through periods of expansion and contraction, institutional participants are placing greater emphasis on governance, operational resilience, and long-term structural alignment.

- G-Coin Isn’t a Meme Token. It’s the Engine Behind 1,500+ Live Platforms

In a market flooded with tokens built on narrative cycles, influencer momentum, and speculative hype, very few digital assets are directly tied to operating infrastructure. G-Coin is attempting to position itself in that minority.

- Bitcoin Dips Below $69K Support Again: Emerging Breakout Pattern Signals Reversal? – BTC TA February 16, 2026

The Bitcoin price took a dip below the major $69,000 on Sunday. That said, the price is keeping very close to this level. In addition, a breakout pattern is emerging. If the $BTC price can break up and out of this pattern, $82,000 could be the target.

- Rizz Network Lands $5M Capital Commitment from Nimbus Capital to Drive Next-Generation AI-DePIN Rizz Wireless Rollout

Rizz Network Inc. (“Rizz” or the “Company”), the issuer of RZTO, today announced that Nimbus Capital has entered into a strategic investment commitment in RZTO, marking what industry observers describe as one of the most widely anticipated ecosystem investments of 2026.

- Crypto Savings Accounts Ranked: APY, Liquidity, and Risk Compared [2026 Review]

Crypto savings accounts ranked for 2026. Compare APY, liquidity, and risk across Clapp, Nexo, Binance, Coinbase, and more.

- How to Check Mining Profitability: A Step-by-Step Guide

Discover how to check mining profitability easily. Follow this step-by-step guide to set up, calculate, and verify your crypto mining profits accurately.

- Bitunix Launches Valentine’s Day Campaign With Luxury Gifts and a 810,000 USDT Trading Contest

The world’s fastest-growing cryptocurrency exchange, Bitunix, is celebrating Valentine’s Day with a limited-time campaign that combines luxury prizes, trading competitions, and wealth management opportunities. Running from February 13 to February 28, 2026, the campaign is open to users worldwide and offers multiple ways to participate and win.

- Where Players Gamble with Confidence: Best Licensed Web3 Casinos in 2026

Discover how the best licensed Web3 casinos in 2026 balance total player privacy with global compliance. Explore our expert guide to top-rated platforms like Dexsport and FanDuel, featuring on-chain transparency, instant payouts, and zero-KYC gaming.

- Best Hybrid Betting Platforms: Fiat-Friendly with Anonymous Crypto Options

Discover the top hybrid betting platforms of 2026 offering fast crypto payouts, fiat-friendly deposits, full anonymity, and deep sports coverage. Compare features, bonuses, and security to find the best fiat + crypto sportsbook for your style.

- Bitcoin Dollar Buck Boosts Token Yield to 10% and Adds Automated Rewards

Buck has unveiled a major upgrade to its yield-bearing token, infusing it with a generous 10% APY in a move that’s sure to spark industry-wide interest.

- CoinFound and CertiK Join Forces to Expand Web3 Data Transparency and Security Intelligence

CoinFound has entered a strategic partnership with CertiK aimed at strengthening data transparency and on-chain security visibility across the Web3 ecosystem.

- The Silicon Oasis: Why the UAE Is the New Frontier for Blockchain Innovation

Something is sizzling in the Arabian Peninsula. Not the sun – that was already white-hot – but rather a brilliant light emanating from its tech sector. A masterclass in digital transformation is underway as the United Arab Emirates (UAE) flexes its blockchain credentials.

![Q2 2026 Review of Crypto Exchange Aggregators [Terms and Execution Compared]](https://images.cryptodaily.co.uk/space/863img.png)

![Crypto Savings Accounts Ranked: APY, Liquidity, and Risk Compared [2026 Review]](https://images.cryptodaily.co.uk/space/818img.png)